Pa Sales Tax Due Dates 2025. The pennsylvania department of revenue (dor) sept. Arkansas sales tax holiday 2025.

You are still required to file a sales and use tax return according to your current filing frequency, which may differ from your quarterly consumer fireworks tax.

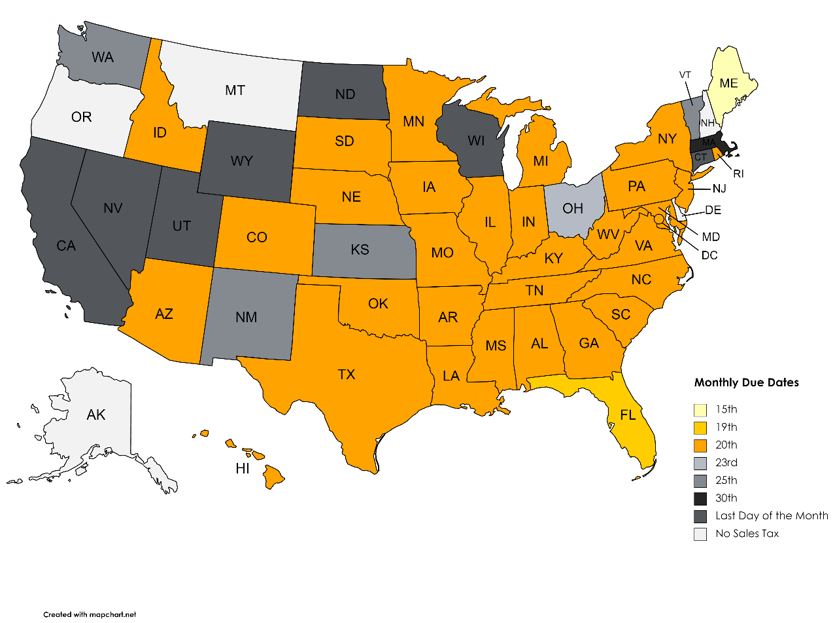

January 2025 sales tax due dates TaxJar, List of local sales tax rates. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any.

Pennsylvania 2025 Sales Tax Guide, 15th and last day of month. A seller is liable for reporting tax.

State Sales and Use Tax Due Dates Lexology, Arkansas sales tax holiday 2025. Sales tax info for businessowners.

Pennsylvania Sales Tax Calculator Step By Step Business, When are returns and payments due for pennsylvania sales, use and hotel occupancy tax? Tax period tax period end dates due dates.

20172024 Form PA REV72 Fill Online, Printable, Fillable, Blank, You are still required to file a sales and use tax return according to your current filing frequency, which may differ from your quarterly consumer fireworks tax. Arkansas sales tax holiday 2025.

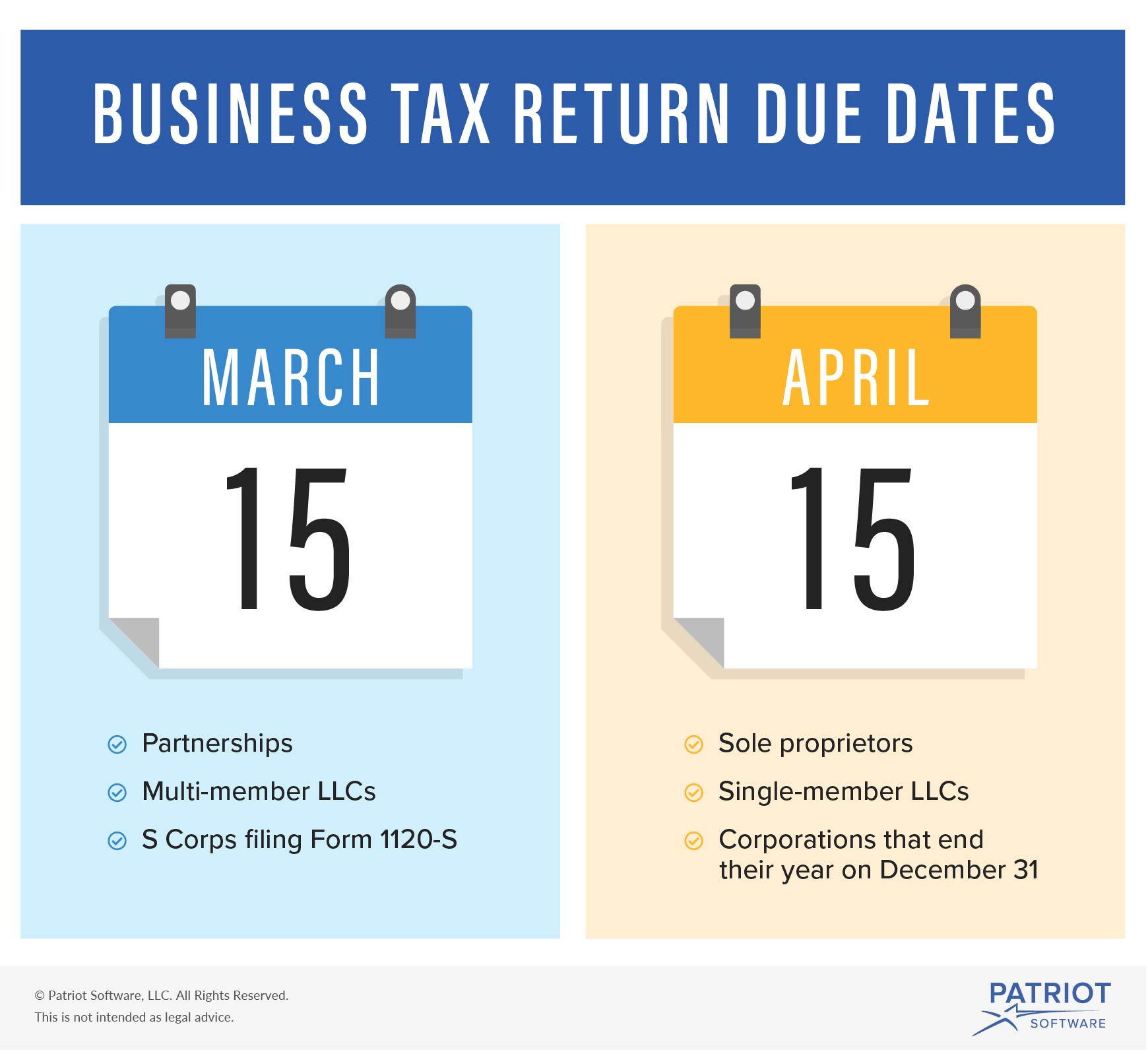

2025 Tax Deadlines for the SelfEmployed, 15th and last day of month. And though the religious group is seeking tax exempt status for 2025, it paid the 2025 taxes, so the local school district and municipalities wouldn’t be left.

Pennsylvania Sales Tax Guide for Businesses, When are returns and payments due for pennsylvania sales, use and hotel occupancy tax? List of local sales tax rates.

Lista de verificação para preparação de impostos para pequenas empresas, The due date for the deposit of tax deducted/collected for february 2025. Tax liability due for the same month of the preceding year.

When are taxes due in 2025 areatiklo, Answer id 3594 | published 01/02/2019 04:42 pm |. Sales tax due dates 2025:

[Updated] Ultimate Guide to Company Filing & Deadlines (2025), On this page we have compiled a calendar of all sales tax due dates for pennsylvania, broken down by filing frequency. 2025 pennsylvania sales tax handbook.

Beginning tax year 2025, the income threshold for when estimated payments are required to be made has increased from $8,000 to $9,500.

![[Updated] Ultimate Guide to Company Filing & Deadlines (2025)](https://res.cloudinary.com/goforma/image/upload/v1598346954/small business accounting/VAT_filing_quarters_payment_dates_deadlines_soyalw.png)